California Teen Brings Financial Literacy to Gen Z

Meet Daily Point of Light Award honoree Aadi Gujral. Read his story, and nominate an outstanding volunteer or family as a Daily Point of Light.

Aadi Gujral’s Sikh culture means that being in service has always been a part of his life. When he realized how many of his peers lacked financial literacy, the California teen decided to launch the Foundation for Financial Literacy, or FinLitFun, a nonprofit dedicated to bringing financial literacy to young people. Through engaging programming such as online games, FinLitFun has taught foundational financial concepts to more than 3,000 users worldwide and raised more than $25,000.

What inspires you to volunteer?

My younger brother’s impulsive Pokémon Go and TikTok Made Me Buy It shopping sprees, as well as my own impulse shopping, awakened me to the destructive prevalence of our instant gratification culture.

While our dopamine receptors are always happy, people get hooked on instant gratification and this can have devastating financial consequences. Kids are taught at a very early age to want, and to get, but they aren’t taught how to manage their money. I knew I had to address the glaring financial literacy gap faced by students.

Tell us about your volunteer role with FinLitFun.

FinLitFun.org, or the Foundation for Financial Literacy, is a 501(c)(3) nonprofit initiative I founded four years ago to bring essential financial education to youth, particularly in underserved communities. My first project was to create an online simulation called Lemonade Stand. This game is aimed at kids aged 8 to –12. It takes kids through financial choices and outcomes. The goal is to save enough money from their lemonade sales to buy a bicycle. This fun game helps to make complex financial concepts accessible to Gen Z kids. There are currently over 3,000 users worldwide.

I also write blogs and op-eds to raise Gen Z’s financial literacy. I’ve been featured in Fast Company, where I wrote about the mindset and culture of money; and on Fox5 where I talked about the importance of financial literacy among the youth. We have also integrated our financial literacy curriculum into school systems.

We have raised over $25,000 to fund various initiatives. Key mentors who are actively involved in FinLitFun include Aimee Kerr, my school’s personal finance teacher, Bhupinder Anwar, my school’s computer science teacher and tech entrepreneur Steve Hoffman, creator of the educational entrepreneurial game Gazillionaire.

What inspired you to get started with this initiative?

The desire to help my generation become financially literate grew from seeing the effects of poor financial literacy in my immediate circle that included my younger brother, myself and my friends. As I learned more about financial literacy I realized that the status quo around financial literacy is nowhere near where it needs to be. We’re taught to consume, but not to manage our money. This leads to a lifetime of bad spending habits and debt-slavery.

I am working with startups all around the world including Kazakhstan, Cambodia and Hong Kong. We are collectively looking at how finances are influenced by culture, technological accessibility and other factors. What started with my brother in the living room has become a global platform for financial literacy.

What are your long-term plans or goals for the organization?

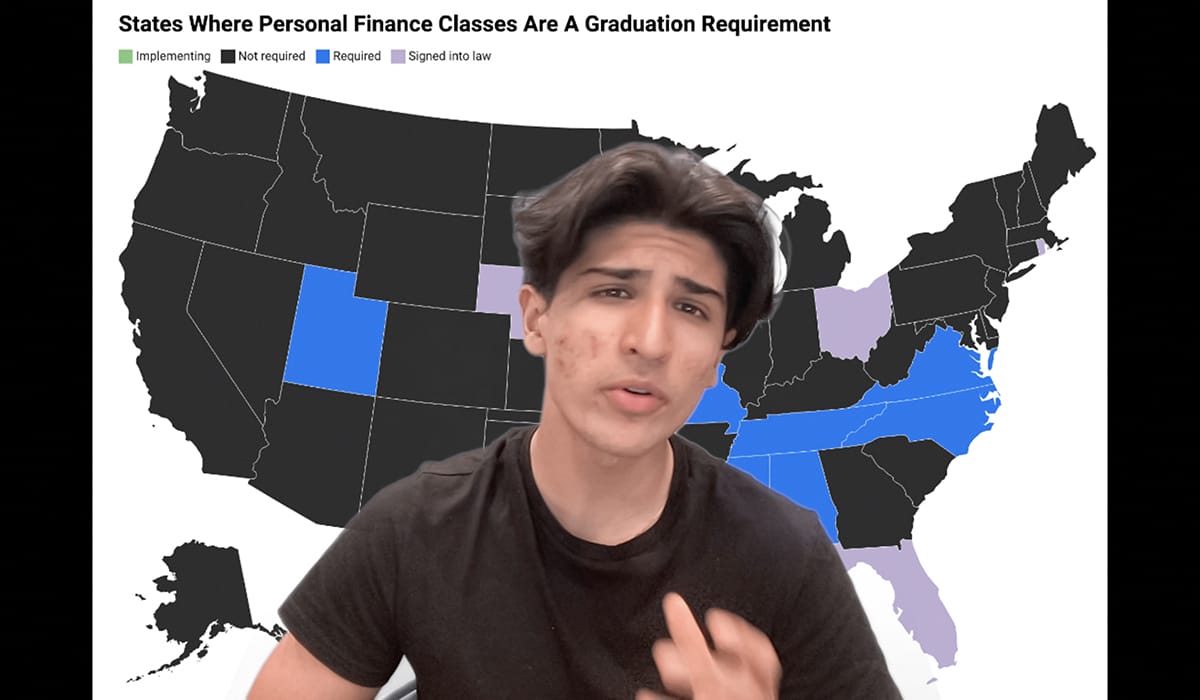

I want to continue to expand FinLitFun globally and disrupt the status quo around financial literacy. A huge goal is to integrate FinLitFun into every school curriculum because I feel that financial literacy is just as important as any other subject, yet only 22 states now mandate high school financial literacy courses. This is grossly inadequate. It’s a graduation requirement in these states, but it should be accessible to all students everywhere because learning financial skills early can shape the rest of their lives.

Our instant gratification debt culture often leads to generational poverty and a fear-based psychology around money. Students also need to be educated in how to let go of FOMO, or the fear of missing out. We are learning calculus at young ages but practical skills like budgeting are being ignored. It’s ironic because personal finance is so easy to teach and can set people up for success in life.

My brother is involved in FinLitFun too. He gives an even younger perspective as a 13-year-old which can help us reach a younger audience.

What’s been the most rewarding part of your work?

It’s been rewarding to see FinLitFun scale. We have experienced exponential growth. Small actions snowballed into big changes, and this continues to inspire me. Thousands of people are now experiencing the benefits of what I’ve done.

What have you learned through your experiences as a volunteer?

I’ve learned to hustle. It can be hard to gain traction in the beginning. Being in high school when I started FinLitFun, at first nobody took it seriously in terms of its potential impact. It was seen as a passion project for me so I got support, but people didn’t see how far I could take it.

At first, the only users were my brother and myself. Getting people to rally behind my cause was difficult but I didn’t give up. I spoke to my principal, went to school board meetings and spoke to policymakers. I am grateful to have the support of my teachers. It’s all about initiative and drive. If you keep pushing and challenging, anything is possible. The main challenge I’ve had to overcome, though, was my own fear. As a small child, my mom once asked me to go into Starbucks to get a straw but I was too scared. Fast forward to today. I’ve been on TV and I’ve spoken to people all around the world. I’m so passionate about what I’m doing that I forget my own fears and sense of inadequacy.

Tell us about future partnerships, programs or events that you are excited about.

The big new partnership is working with an incubator, an opportunity that came about through one of the op-eds I wrote. The Global Possibility Network: Youth Entrepreneurs Initiative chose six social projects from around the world to support. I’ve been nominated as the United States representative. We are working together to scale our initiatives internationally.

I am also receiving great mentorship from several University of Pennsylvania (UPenn) professors. I have also joined as a Student Fellow of the National Education Equity Lab. This organization offers free financial literacy courses to Title One schools. This serves kids who wouldn’t otherwise have access to these courses. I give the Gen Z perspective to their initiatives.

Why is it important for others to get involved with causes they care about?

It’s all about impact. One stick alone can break, but a bundle of sticks is strong. One person can make a difference, but when you rally people behind a cause, the collective energy and efforts can bring about tangible change.

Any advice for people who want to start volunteering?

In the words of the Nike slogan, “just do it.” There’s nothing hard about starting. If you care about something, you can volunteer. You immediately feel so good and accomplished on a personal level, but if you stick to working with a cause you are passionate about, it’ll have a ripple effect. You have no idea in the beginning how massive your impact and reach can be. It becomes so enjoyable that you embody it. You start living and breathing your volunteer journey and it snowballs from there.

What do you want people to learn from your story?

We’re the next generation. We’re the ones with a new perspective. We will be shaping the future. No matter how young you are, you can initiate powerful change.

Do you want to make a difference in your community like Aadi? Find local volunteer opportunities.